what taxes do i pay after retirement

Contributing to a Roth reduces your taxes in retirement because you pay taxes. Those who qualify can contribute up to 6000 in 2020 or 7000 for people age 50 and older.

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

. Your entire benefit from a taxed super fund which most funds are is tax-free. If you have a Roth 401k unlike the traditional 401k your contributions are made with after-tax money. 62 of wages for Social Security capped at 142800 of wages for 2021 and 145 of wages for Medicare no limit for a total.

Between 25000 and 34000 you may have to pay income tax on. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. In the year you reach your full retirement age you can.

Learn the Key Issues Retirees Face Strategies You Can Use to Avoid Mistakes. More than 34000 up to 85 percent of your benefits may be taxable. If youre age 60 or over.

Get matched with up to five investment pros whove been screened by our team. Although Roth 401k has a few advantages you still need to pay Social Security. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes.

Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits. If you take an early distribution from your pre-tax retirement plan you will pay a 25 state penalty in addition to the 10 federal penalty for early withdrawals. Access Insights On Retirement Concerns The Impact Of Taxes.

What is the tax rate on 401k withdrawals after retirement. The percentage amount will be calculated. This is 5440 over the limit.

Your Social Security check will be reduced by 2720 that year or 1 for every 2 earned. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. In general Roth 401 k withdrawals are not taxable provided the account was opened at.

If you received retirement. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Ad Learn How to Manage Taxes in Retirement with Our Free Guidebook - Download Now. Part is tax-free made up of. Distributions from tax-deferred retirement accounts.

When you save in a traditional 401k or IRA you dont have to pay taxes on the money you put into the account. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Ad Afraid of investing because you dont know who to trust.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. FICA taxes are broken down as follows. When you are paying taxes on retirement income on your Social Security income you will be taxed anywhere from 0 to 85.

There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

Tax Filing Tips For Saving Money On Your Taxes

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

What Are Defined Contribution Retirement Plans Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Here S Why Some Retirees No Longer Have To File A Tax Return Retirement Money Social Security Benefits Retirement Retirement Benefits

Top 3 Benefits Of Roth Ira Individual Retirement Account

9 States That Don T Have An Income Tax Income Tax Income Tax

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Understanding The Mega Backdoor Roth Ira

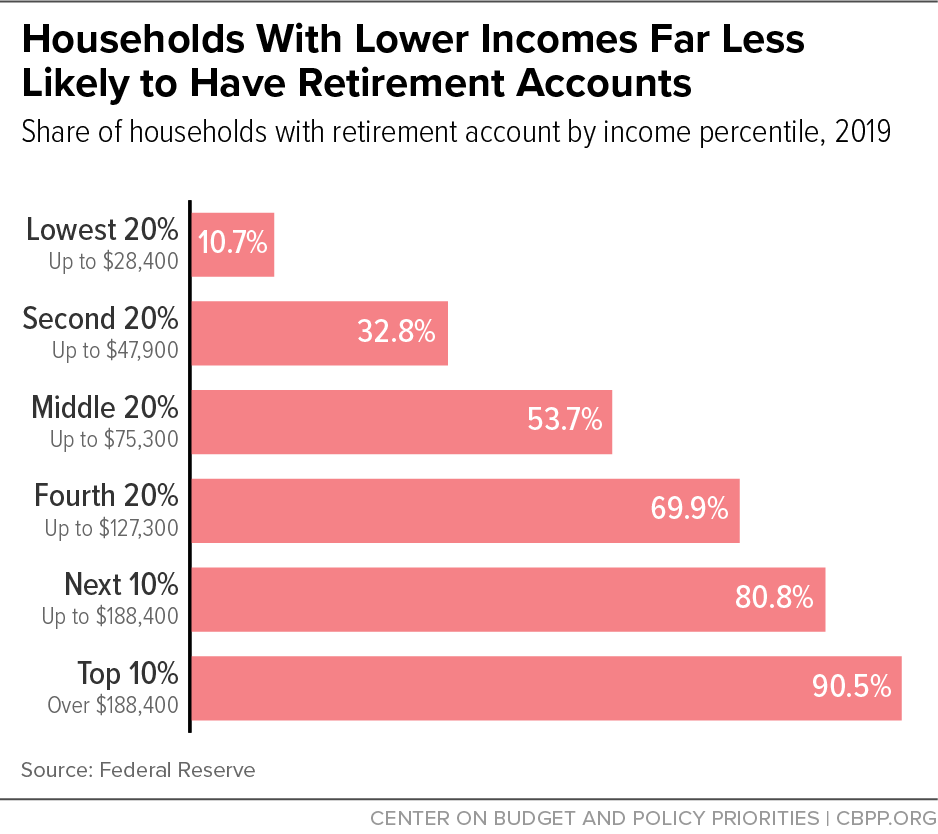

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

The Best Retirement Vehicle You Ve Never Heard Of Www Americanwealthonline Com Ratho Reis Manager Ratho Awg Gma How To Plan Retirement Planning Retirement

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)