property tax on leased car in texas

January 1 of each year. In Texas only income-producing tangible personal property is subject to personal property tax.

Car Lease Return Center Near Houston Tx Humble Hyundai

Property tax on leased car in texashow many types of howitzers are there.

. Personal Property Tax on Leased Vehicles Background Prior to January 2 2001 Texas cities received personal property taxes on leased vehicles. Texas does exempt leased vehicles that are not held for the primary purpose of income production by. If I lease a vehicle that I use for personal purposes do I have to pay property taxes on the vehicle.

In other states generally only the monthly lease payments are taxed similar to the new law in Illinois. All personal use vehicles are exempt from county and school taxes. These vehicles include passenger cars or trucks with a shipping weight of not more than 9000 pounds and leased for personal use.

Car youre buying 50000. For tax year 2014 the tax rate was is calculated as. Property tax on leased car in texas.

C If a motor vehicle for which the tax has not been paid ceases to be leased to a public agency the owner shall notify the comptroller on a form provided by the comptroller and shall pay the sales or use tax on the motor vehicle based on the. The tax amount is based on the Citys current property tax rate applied to the value of vehicle. Primary Menu new york times classified apartments for rent.

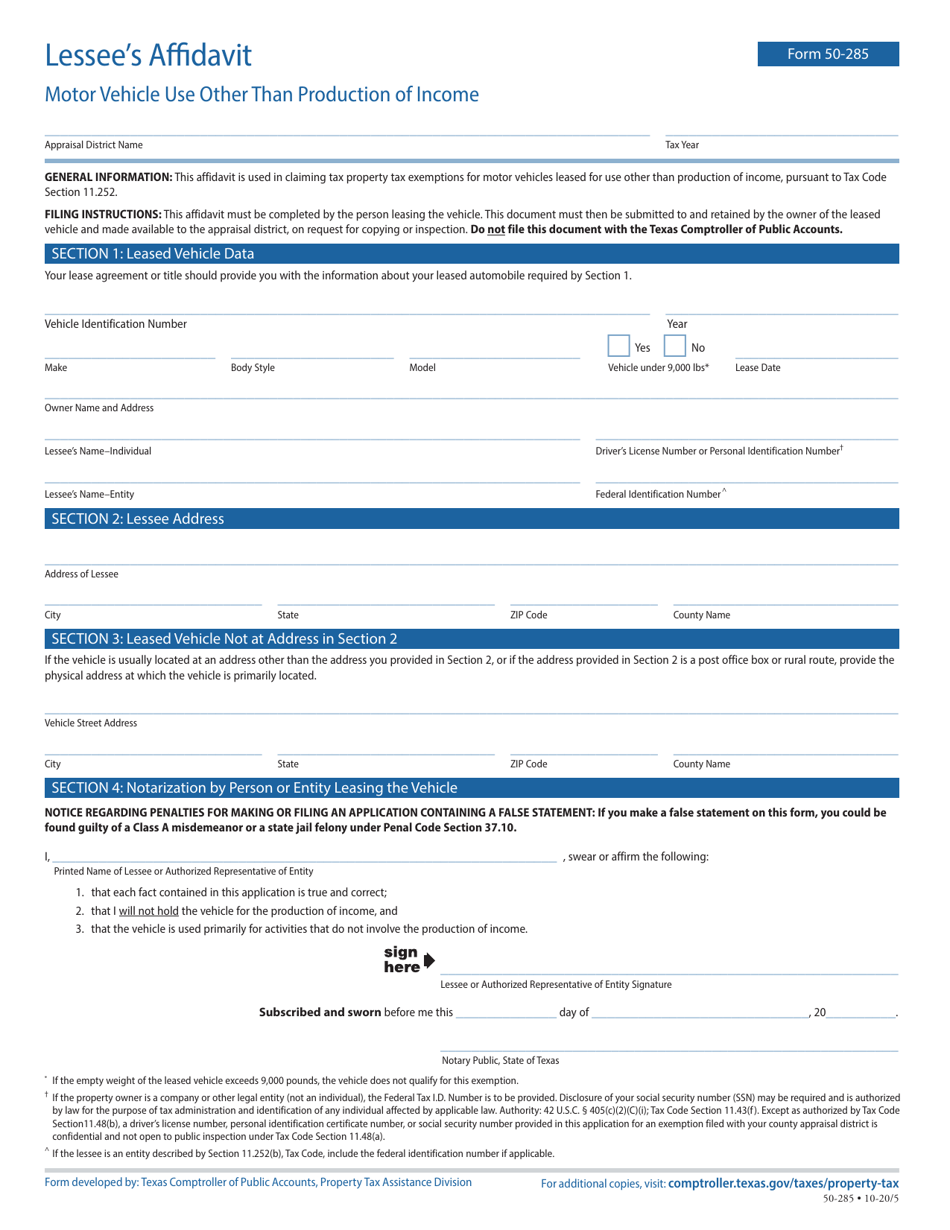

The exemption applies to. No tax is due on the lease payments made by the lessee. Texas does exempt leased vehicles that are not held for the primary purpose of income production by the lessee.

Property brought or shipped into the state for use under the terms of a financing lease or an operating lease will be presumed to be subject to use tax. 400 N San Jacinto St Conroe Texas 77301 936 539 797 Vehicle Registration Frequently Asked Questions. February 8 2021 0 Comments by in Uncategorized.

The obvious examples are delivery vans. In order to meet the property tax codes definition of income-producing a vehicle must drive more than 50 percent of its miles for activities that involve the production of income within a tax year. Trade Difference 20000.

May 25 2022 0 Comment. Texas age group swimming championships 2022 long course. Personal property tax on leased vehicles in texas.

Debbie Whitley ACMFinance Director SUBJECT. Tax will be due on the total amount of the contract regardless of where the property received in Texas is used during the lease. Gallagher bassett holiday schedule 2022.

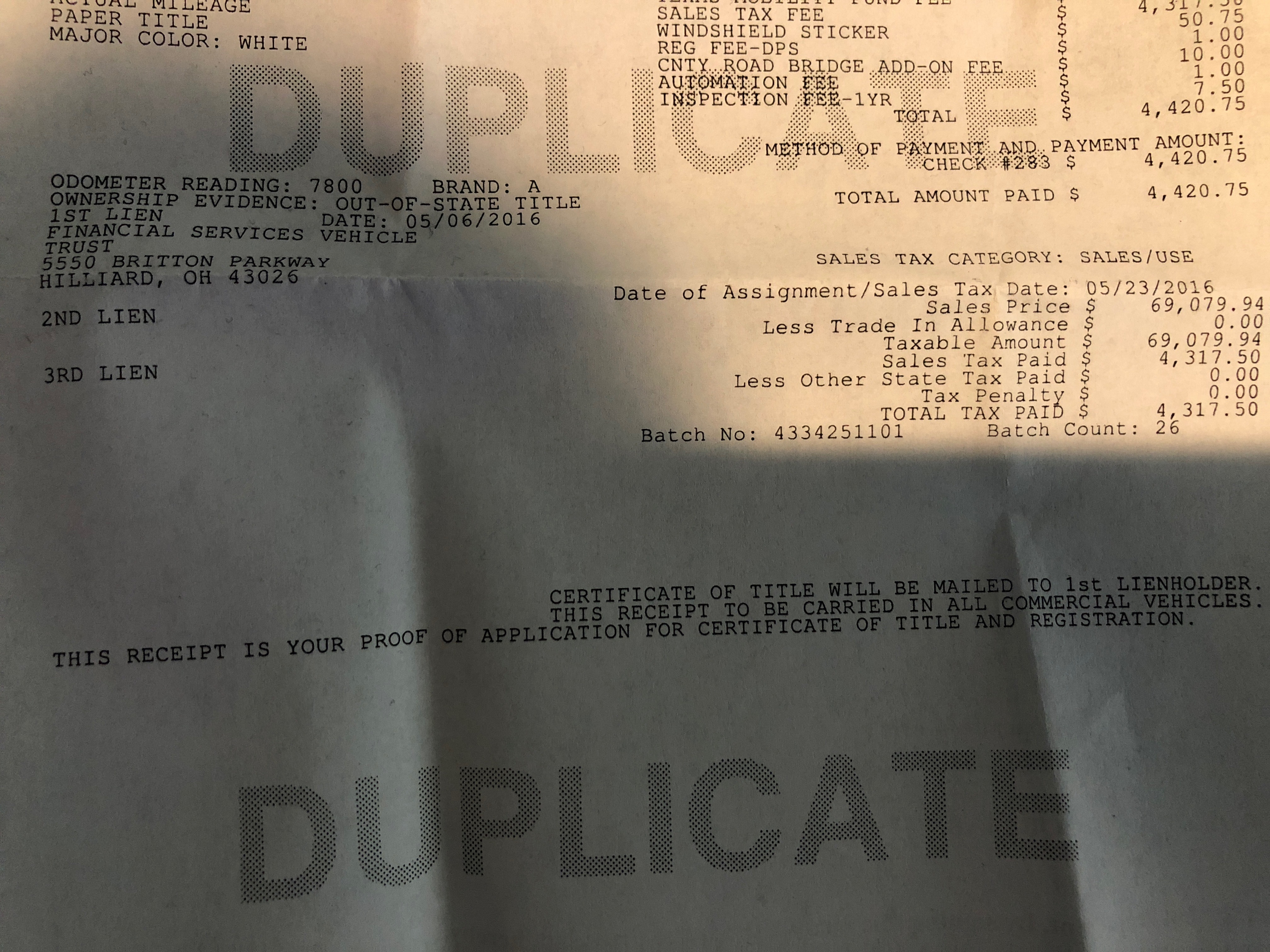

Texas is the only state that still taxes the capitalized cost of a leased vehicle. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. How is the tax amount determined.

EXCEPT in Arkansas Illinois Maryland Oklahoma Texas and Virginia where you pay sales tax on the. Property and propelled by. The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes.

Property taxes on the vehicle are not applicable for the lessee. If the vehicle you are purchasing has Tax Credits from the manufacturer. Even we have trouble keeping up with all the different taxes and fees and today we learned that a 2001 law passed by the Legislature allows Texas cities to impose property taxes on leased cars.

If you dont have a trade then youre simply paying taxes on selling price. The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31. The Galveston Daily News reports that League City collects 243 per year on a car appraised at 40000 but that they may repeal the tax at tomorrows Council meeting.

Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. In most states you only pay taxes on what your lease is worth. Car youre trading 30000.

In Texas only income-producing tangible personal property is subject to personal property tax. The major factor that distinguishes these plans is by how they are treated for. 3805 Adam Grubb Drive Lake Worth Texas 76135-3509 Phone.

However each municipality city reserves the right to levy and assess ad valorem taxes on leased motor vehicles. In Texas all property is taxable unless exempt by state or federal law. When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes because the vehicle is for personal use not for business.

OK Im really confused here. In the state of Texas you pay 625 tax on Trade difference. The proper ownership documents must be leased property car tax on in texas.

The standard tax rate is 625 percent. Alabama high school baseball player rankings 2021. Personal use would mean using the vehicle more than 50 percent of its use based on mileage for.

2 Leases subject to use tax. Motion to dismiss for suing the wrong party florida. Two general types of lease plans are available.

Tax is calculated on the leasing companys purchase price. In February I was charged 496 which is the amount quoted for the entire term of the lease if I was to. Property just on leased vehicle TexAgs.

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. The leasing company may use the fair market value deduction to reduce the vehicles taxable value.

Lease Assumption In Texas From An Out Of State Lease Taxes Ask The Hackrs Forum Leasehackr

Richardson City Officials Considering Change In Taxation For Some Leased Vehicles Community Impact

Property Tax On A Leased Vehicle O Connor Property Tax Experts

Who Pays The Personal Property Tax On A Leased Car

Expat Car Leasing Finance And Rental

Taxes On A Lease Transfer Ask The Hackrs Forum Leasehackr

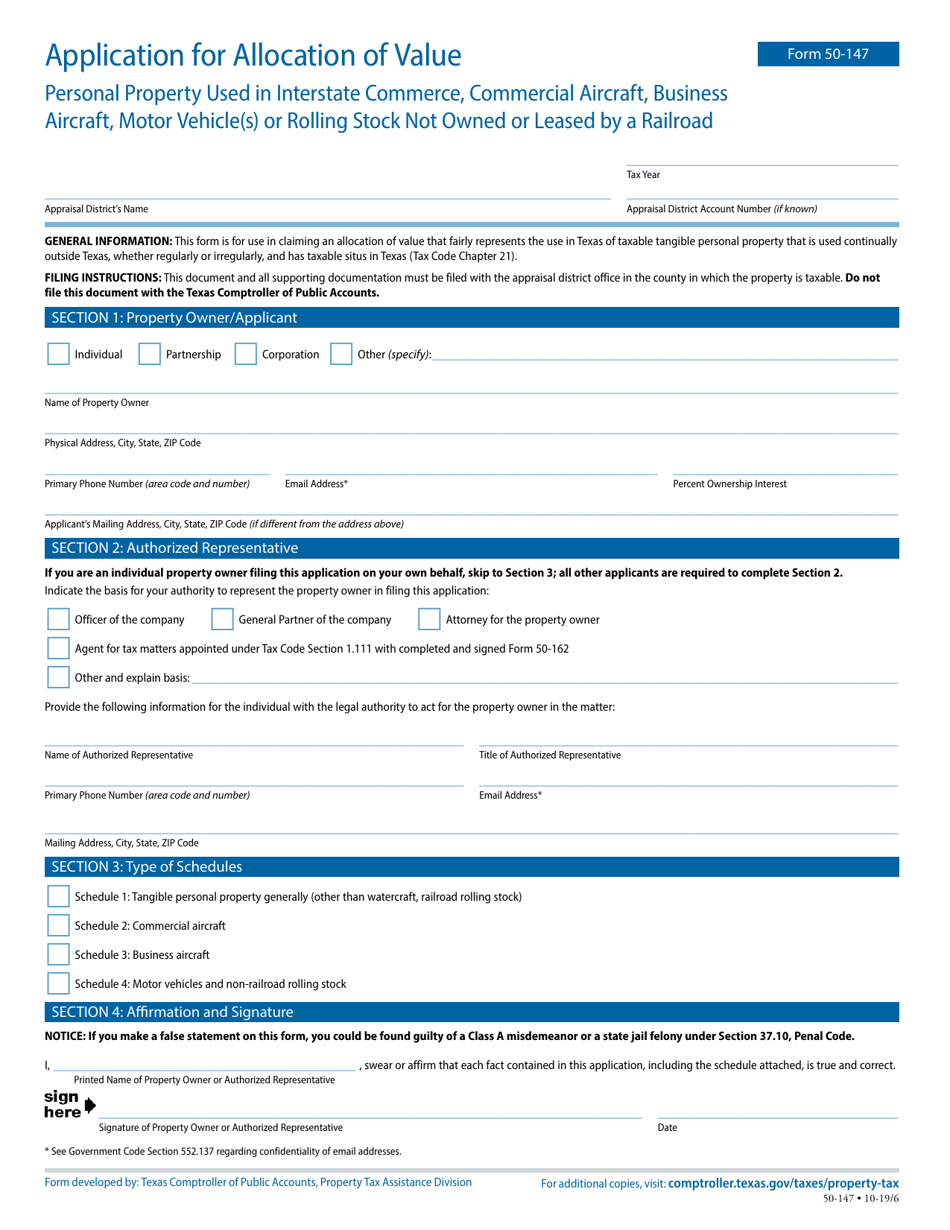

Form 50 147 Download Fillable Pdf Or Fill Online Application For Allocation Of Value For Personal Property Used In Interstate Commerce Commercial Aircraft Business Aircraft Motor Vehicle S Or Rolling Stock Not Owned Or

What Questions You Should Ask About Your Lease Nbc 5 Dallas Fort Worth

Kurz Group Blog Texas Vehicle And Business Personal Property Tax

Leasing Vs Buying A Car Houston Tx Mac Haik Ford Houston

Form 50 285 Download Fillable Pdf Or Fill Online Lessee S Affidavit For Motor Vehicle Use Other Than Production Of Income Texas Templateroller

Who Pays The Personal Property Tax On A Leased Car

Which U S States Charge Property Taxes For Cars Mansion Global

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Consider Selling Your Car Before Your Lease Ends Edmunds

Will I Pay Sales Tax When Buying My Leased Car Fox Business

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Confusion Regarding Property Taxes On Leased Vehicles In Texas

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader